mQuanture

mQuanture App: Real Time AI Clarity For Crypto Choices

Sign up now

Sign up now

mQuanture's dynamic engine studies earnings releases, sector rotation, and price volume waves, then matches each finding against personal targets set during onboarding. The result is an always updated watchlist that flags opportunities in clear, colour coded tiers.

mQuanture's learning core refines forecasts with every closing bell, spotlighting patterns that often foreshadow shifts. Equity markets can be volatile and losses may occur, so the app supplies probability bands instead of trade execution, leaving timing and size entirely in users’ hands.

mQuanture's strategy mirroring panel showcases vetted playbooks from seasoned analysts; toggles let newcomers scale positions safely while experienced traders blend tactics for custom portfolios. Round the clock monitoring by mQuanture, multi factor entry, and encrypted data paths safeguard activity. Seats remain limited, so secure access now before allocation closes.

Whether just dipping a toe into equities or already navigating the fast currents of crypto, mQuanture runs advanced predictive models that sift millions of data points price swings, order‑book shifts, macro headlines translating them into clear suggestions that sharpen every trade, highlight hidden risks, and keep long‑term goals on target. Step straight into a secure dashboard packed with live signals, customised alerts, and intuitive tools designed to elevate decision‑making from day one.

Using instant pattern recognition, mQuanture pinpoints emerging breakouts and rotation themes the moment they surface. A streamlined dashboard pairs traffic light indicators with concise notes, so newcomers and experienced traders can translate complex flows into swift, informed action, all without wading through clunky menus.

Adaptive neural networks inside mQuanture learn from decades of historical swings, isolating behaviours that often precede momentum shifts. Insight cards highlight critical changes in sentiment and liquidity, presenting risk levels in an easy to scan format and letting users recalibrate goals before conditions accelerate.

mQuanture supplies a strategy mirroring panel where vetted playbooks from seasoned analysts sit side by side with live analytics, enabling manual adoption at custom position sizes. Stock markets can be volatile and losses may occur, so every tactic arrives with probability bands rather than promises.

mQuanture captures your targets, risk comfort, and preferred markets, then issues timely prompts whenever conditions match those objectives. As you act, mQuanture records the outcomes and refines its models, ensuring each new suggestion delivers sharper, more relevant support.

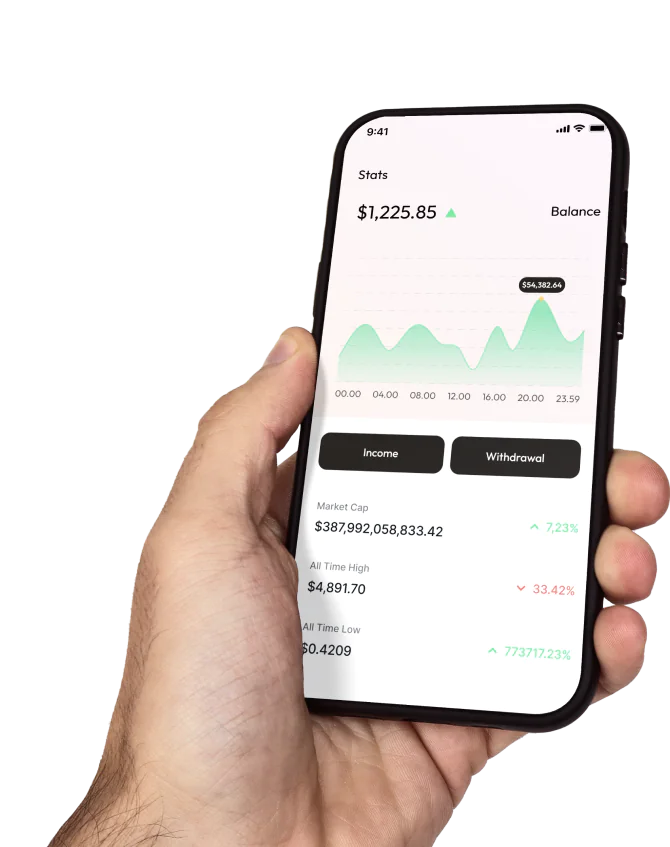

Within a single dashboard, mQuanture streams live order‑book depth, sentiment shifts, and headline events, updating every second. Colour cues and percentage gauges highlight emerging momentum, giving ample opportunity to enter, exit, or rebalance before prices swing again.

mQuanture pairs clear layouts with swipe gestures and context tips that flatten the learning curve, letting newcomers master advanced tools quickly. Custom watchlists, one‑tap filters, and dark‑light themes keep vital data front and centre, whether you are checking markets on the move or analysing trends at home.

mQuanture unites AI‑curated market signals, a scenario‑driven return calculator, an interactive investment diary, and live price feeds in one secure hub, equipping every trader with clear guidance, disciplined tracking, and data‑backed confidence.

Harness continuous pattern recognition, sentiment analysis, and risk flags at mQuanture that translate complex stock and crypto data into plain‑language guidance, empowering decisive action without the guesswork.

Adjust deposit size, timeframe, and asset mix to view instant what‑if scenarios. Clear metrics at mQuanture reveal how capital might grow under various market conditions, helping refine allocation plans before committing funds.

At mQuanture record every buy, sell, dividend, and cashflow in one place. Interactive charts track performance day‑by‑day, spotlighting spending leaks, profit streaks, and overall financial momentum in real time.

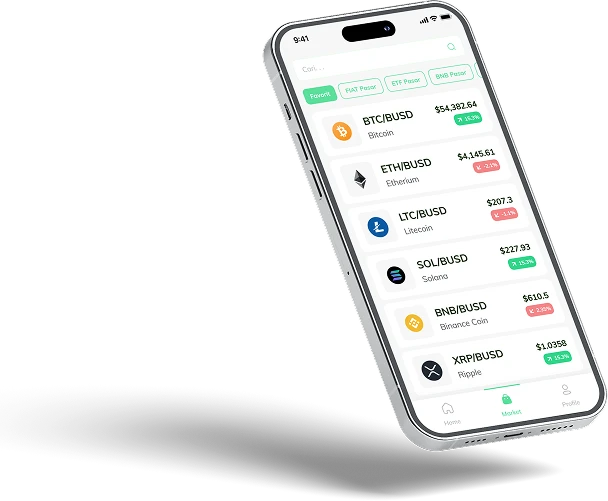

Streaming quotes for leading equities and headline cryptocurrencies display spreads, volumes, and percentage shifts at a glance, enabling quick comparisons and timely entries when conditions align.

Within mQuanture, adaptive neural engines sift live order book flux, news bursts, and macro signals in milliseconds. Pattern detection models pinpoint timing windows, position zones, and shifting correlations, then translate them into clear dashboards that suit every experience level. Data driven alignment replaces guesswork, paving the way for deliberate moves in fast moving equity and digital asset arenas.

By combining sentiment mapping with curated playbooks, mQuanture's analytics highlight strategy templates proven by seasoned market coaches, yet all execution choices remain firmly in user hands. Copy trading modules showcase tactics worth studying, while 24/7 monitoring keeps fresh alerts flowing, so evolving conditions never catch traders off guard. The approach encourages disciplined, informed reactions, free of profit promises or automated trade triggers.

Robust defences sit at the core of mQuanture; multiple encryption layers, role based authentication, and audit trail logging shield every data fragment from unauthorised exposure. Around the clock support and a friction light interface welcome newcomers and veterans alike. Whenever questions arise, mQuanture offers structured guidance and secure resources that foster confident, systematic participation in today’s dynamic markets.

A disciplined framework promotes consistency across varied market climates. mQuanture supports multiple trading styles, from intraday momentum plays to multi year positioning, by mapping price action, historical patterns, and personal risk limits into custom roadmaps that fit broader equity cycles.

The machine learning core inside mQuanture spots trend inflections and volume shifts in real time, then pairs those findings with copy trading templates and back test tools. Users compare tactics side by side, refining decision sets as objectives evolve and confidence grows.

Some traders favour swift rotations; others prefer holding through macro waves. The analytic engine powering mQuanture benchmarks both approaches, highlighting volatility exposure, capital efficiency, and psychological demands, so each user can align strategy length with comfort level and market outlook.

Order book depth influences timing, spreads, and execution risk. mQuanture continuously measures liquidity conditions across sectors, flagging stable corridors and thin zones alike. Insight into flow dynamics helps users calibrate entry size, exit routes, and portfolio hedges with greater precision.

Clear thresholds shape disciplined action. Leveraging adaptive AI thresholds, mQuanture surfaces probable support, resistance, and sentiment pivots, guiding traders toward predefined stop loss and review points. Visual dashboards emphasise potential risk pockets and timely reassessment levels, fostering systematic, emotion controlled engagement.

Machine learning engines scan order flow surges, macro releases, and crowd sentiment in milliseconds, then distil the turbulence into plain language context. By anchoring decisions in live, data driven observations, mQuanture nurtures disciplined timing, balanced positioning, and adaptable strategy updates, always leaving execution choices fully in user hands.

To sharpen analysis, mQuanture assembles an extensive indicator suite Relative Strength Index, Bollinger Bands, Fibonacci levels, and Moving Average Convergence Divergence and each converted into intuitive dashboards that flag potential turning points and momentum shifts.

Fibonacci ratios spotlight likely retracement zones, RSI tracks overbought or oversold pressure, while MACD traces trend direction. The combined insight clarifies when prices may stretch or stall, guiding users toward methodical plan adjustments that align with individual goals.

By filtering noise through adaptive neural layers, mQuanture converts raw indicator data into concise, real time alerts, enabling traders to refine strategies as patterns evolve while retaining full control over every market decision.

Real time sentiment mapping translates headlines, social chatter, and order flow shifts into a clear gauge of optimism or caution. By feeding this pulse directly into adaptive dashboards, mQuanture supports timing, position sizing, and risk awareness with context that raw price data alone cannot provide.

AI language models trawl thousands of news outlets, forum threads, and trading transcripts every second, isolating decisive tone changes and volume spikes. Weighted algorithms rank each source for relevance, filter out noise, and flag turning point signals moments after they surface thus helping users prepare measured responses when crowd psychology swings.

Combined with technical metrics, sentiment intelligence delivers a rounded market portrait. When bullish confidence rises beside strengthening momentum, mQuanture highlights zones worth closer study; if anxiety builds while liquidity thins, the system spotlights caution areas for review. This integrated approach gives traders of every experience level a concise, context aware guide without dictating or automating final decisions.

Timely intelligence shapes competitive positioning. mQuanture applies predictive neural modelling to detect liquidity build ups, order book imbalances, and sentiment pivots minutes, sometimes hours, before they ripple across broader markets. By highlighting these early catalysts, the app equips users with a forward looking lens that supports decisive, strategy aligned action while conditions remain favourable.

Algorithmic signal layers inside mQuanture cross reference macro releases, sector rotation cues, and volatility clusters in real time, then dispatch multi device alerts the moment critical thresholds activate. Continuous monitoring ensures that pivotal information reaches traders without delay, allowing preparation rather than reaction when sudden moves emerge.Proactive dashboards convert complex probability outputs into concise risk reward snapshots, helping users refine entry timing, position size, and contingency levels before price acceleration takes hold. Anchored by robust encryption and transparent governance, mQuanture delivers this early warning capability without automating execution or promising outcomes, keeping full control, and a vital competitive edge, firmly in the user’s grasp.

Regulated data management protocols and multi layer encryption keep every insight generated by mQuanture transparent, verifiable, and shielded from unwanted exposure, cultivating confidence before any commitment is made.

Usage caps guarantee server bandwidth remains devoted to each account, so registering now secures uninterrupted delivery of AI driven alerts the moment changing conditions appear, an advantage available only while openings remain.

Sound diversification cushions portfolios against abrupt swings. By evaluating cross asset history and real time correlations, mQuanture supplies AI ranked allocation scenarios that mirror current market tone, backed by transparent data governance and independently audited safeguards.

Lightning fast neural networks filter background noise, flagging micro moves before they widen. Real time prompts from mQuanture help recalibrate entry points and stop levels, while encrypted alert channels uphold privacy and reinforce app reliability.

Momentum often gathers quietly; pattern recognition engines within mQuanture detect building energy early, converting fragmented signals into concise risk reward snapshots so users can prepare positions with discipline rather than haste.

Comprehensive volatility mapping clarifies sudden spikes and prolonged lulls. To keep response times razor sharp, mQuanture limits active seats; completing registration on this page secures priority access to these AI dashboards before admission pauses, providing a trusted edge when uncertainty surges.

mQuanture fuses advanced neural computation with seasoned market interpretation to refine decision pathways across dynamic asset classes. Machine learning pipelines sweep vast data streams, pricing feeds, macro headlines, and sentiment signals, then translate statistical relationships into concise, context rich summaries reviewed by domain specialists. This dual layer workflow balances algorithmic depth with human judgement, giving users structured intelligence they can trust.

By integrating adaptive modelling with user directed control, mQuanture maintains clarity while adjusting insight streams to shifting trends. Pattern recognition, risk markers, and momentum cues appear in real time, yet strategic choices remain entirely in the hands of each trader. The result is a flexible, data supported compass that keeps meaningful market movements firmly on the radar.

mQuanture applies user profile parameters, such as risk tolerance, preferred sectors, and time horizon, to adaptive AI models that filter market data, resulting in personalised dashboards aligned with chosen goals.

Continuous monitoring modules inside mQuanture track liquidity shifts, sentiment waves, and technical triggers, issuing instant alerts when conditions match pre set criteria, so users can evaluate opportunities while they are still forming.

A streamlined interface, guided tooltips, and modular analytics allow beginners to learn quickly while offering seasoned participants depth through advanced charting and strategy testing suites, all within mQuanture's secure environment.

| 🤖 Cost of Registration | No cost involved for joining |

| 💰 Charges | Services provided without fees |

| 📋 Registration Details | Easy and fast to get started |

| 📊 Focus of Learning | Knowledge on Cryptocurrencies, Foreign Exchange, and Diverse Investments |

| 🌎 Service Availability | Offered in the majority of countries, USA excluded |